Unlike dispensed beverage bars in convenience stores, the cold vault remained open and busy last year, capitalizing on the forced closures of soda fountains and self-serve coffee stations. Last year was an outlier in many respects, so can convenience retailers expect similar growth in packaged beverages in 2021?

Don’t set your planograms using data from 2020.

Jim Jacko, senior category manager, Coen Markets, the Canonsburg, Pennsylvania-based retailer with 60 locations, recapped 2020’s performance and shared insights about what lies ahead. Despite nationwide lockdowns, restrictions on foodservice and indoor dining and consumers making fewer convenience store visits in 2020, the packaged beverages category was active.

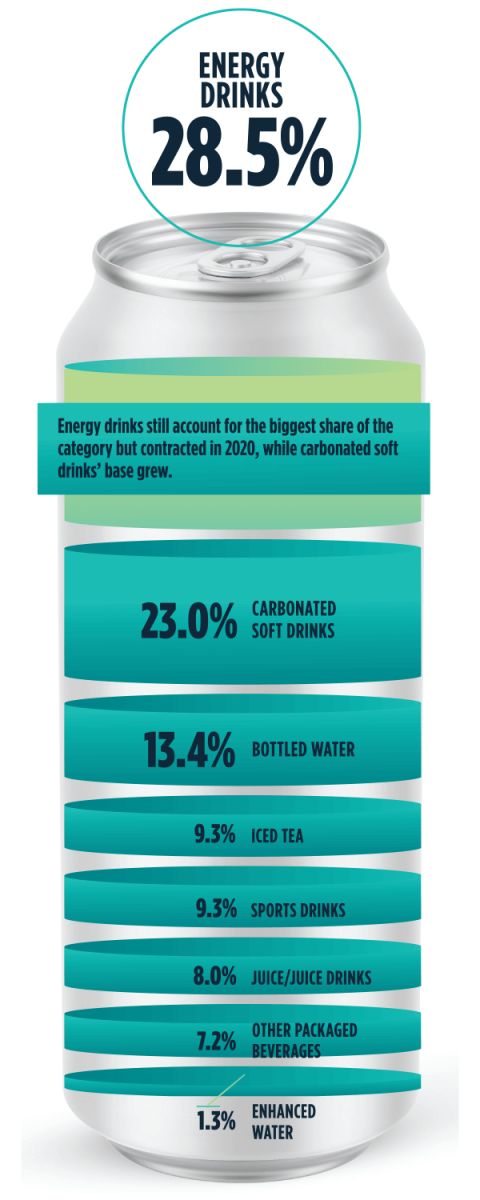

“For some time, the packaged beverages category has held the No. 2 ranking and share of inside sales and the No. 1 ranking in gross margin contribution,” Jacko said. “This year was no different, as the category represented 15.6% of in-store sales and 19% of in-store margin contribution. I consider this a superstar category,” he said.

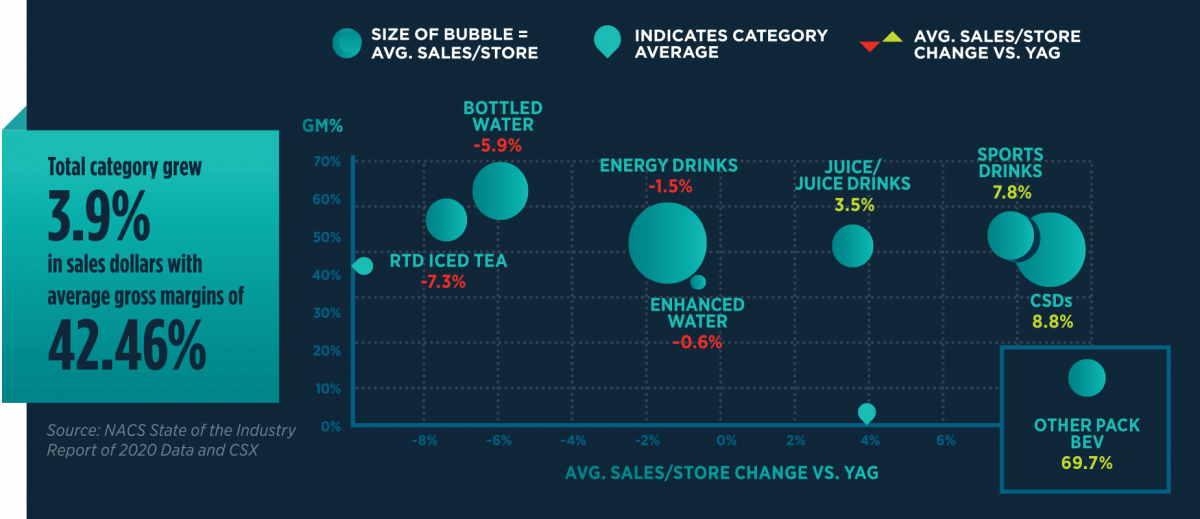

“We’ve seen continued growth over the years but massive growth in 2020,” he added. Sales of carbonated soft drinks were up 8.8%. “More people were purchasing two liters and 12-packs to take home … and I expect this category will come down a little bit once more restrictions are lifted.”

Sports drinks saw a “decent lift” of 7.8%, he said. “Mainline Gatorade fell off a bit but was promptly replaced—and then some—by the continued growth of Gatorade Zero and Bodyarmor brands.”

Juice and juice drinks were up 3.5%, and Jacko credits some of that jump to regions where Naked and Tropicana juices became available from PepsiCo route drivers as opposed to the limited distribution available from warehouses.

However, not all subcategories were winners. Sales of energy beverages declined 1.5% as mainline offerings softened. “With increased trips, I suspect we’ll see the return of this category in 2021,” Jacko said.

Bottled water sales were down 5.9% over 2019. “Out of stocks on take-home and an abundance of water inventory at home likely caused some of the decline,” he said. “Premium and sparkling waters are growing at a rapid rate but not overcoming the decline of base still water.”

The sharpest decline in the category came from RTD iced tea, down 7.3%. “There is a lack of low-sugar options,” he said. “Big brands have quashed innovation, and alternative teas—like kombucha—are still looking for national mainstream acceptance.”

Watch for New Products

Consumer behavior during the pandemic opened the door to new category considerations. “We saw the emergence of new brands in categories such as RTD coffee,” Jacko said. “The restrictions on dispensed coffee beverages in some areas greatly increased the traffic headed to the coolers to get that morning caffeine fix. And we have an underlying generational shift in the coffee category. I’ve seen articles about younger consumers preferring the innovation that the RTD coffee section gives them.”

The restrictions on dispensed coffee beverages in some areas greatly increased the traffic headed to the coolers to get that morning caffeine fix.

“Functional beverage” has been a buzzword for several years, and “the term seems poised to affix itself to all the subsections in the cold vault,” he said. “We’ll see an abundance of new brands that blend the subcategory lines and add increased function in 2021 and beyond.”

And don’t ignore the increased awareness of CBD-infused beverages. Currently, they’re expensive, he said, but the cost will drop over time. Retailers should be thinking now about where this product will go in the vault, how it will be promoted and how it will be handled.

RTD Promotions

As c-store visits increase, retailers must consider promotional strategies to drive sales and engagement. And they need to control and analyze the promotions they run.

“Great resources come from our bigger beverage vendors, but don’t rely on them to bring you promotions,” said Jacko. “Analyze your promotions and understand the purpose for having them. What are you trying to achieve? Do you want to increase units? Are you using it to launch a brand? Do you even need to run a promotion right now?”

Set goals for a promotion in advance and do a recap afterward. “Understand how much growth came from the promo,” he advised. “Keep a history of it and go back to it. Use it as a leverage tool when you’re discussing funding programs with the big brands.”

Space Travel

Rethinking how you allocate products in the vault can drive innovation and excitement.

Since every store must manage limited cooler space, “look at what products are making money and let those metrics dictate what goes in your sets,” said Jacko. “Don’t set your planograms using data from 2020. Look at the past few years, and if you see brands growing, take note. Don’t think of your facings as a way to control inventory. Proper metrics will sort that out for you. You built a cold vault with space to keep backstock. Don’t be afraid to use that space.”

More people were purchasing two liters and 12-packs to take home … and I expect this category will come down a little bit once more restrictions are lifted.

If a big brand does planograms for you, its representatives can provide this information at a line level. “You will know how much your distribution is across the board, and you can do some calculations about what each product is doing for you,” he said. “But one metric doesn’t tell the whole story. Sales are subject to retail increases, cost increases and promotional activities. Take a fully wholistic look at the metrics.”

Jacko believes that retailers must embrace the future while keeping an open mind about new products, trends and technologies. “Go outside the box a little bit. It’s okay to find a new energy drink that may or may not be successful,” he said. “Put your core in first and then bring in your innovation.”

Jacko sees packaged beverages as an impulse item, yet still a predetermined shop. “Beverage shoppers love to buy in multiples, and packaged beverages is a one-size-fits-all category,” he said. “There’s something for everyone, and it’s one of the few categories where you have almost no consumer gaps if you do it right.”